My thesis is simple: Robinhood is the best-positioned broker and emerging fintech super app set to dominate retail investing and personal finance globally over the next decade. And it will keep expanding

The key drivers: a cash-cow recurring revenue stream, ever-expanding audience and service, along with relentless innovation and ease of access. The stock has surged 10x over the past two years, and despite a premium valuation, future catalysts such as S&P 500 inclusion and global expansion provide significant upside potential.

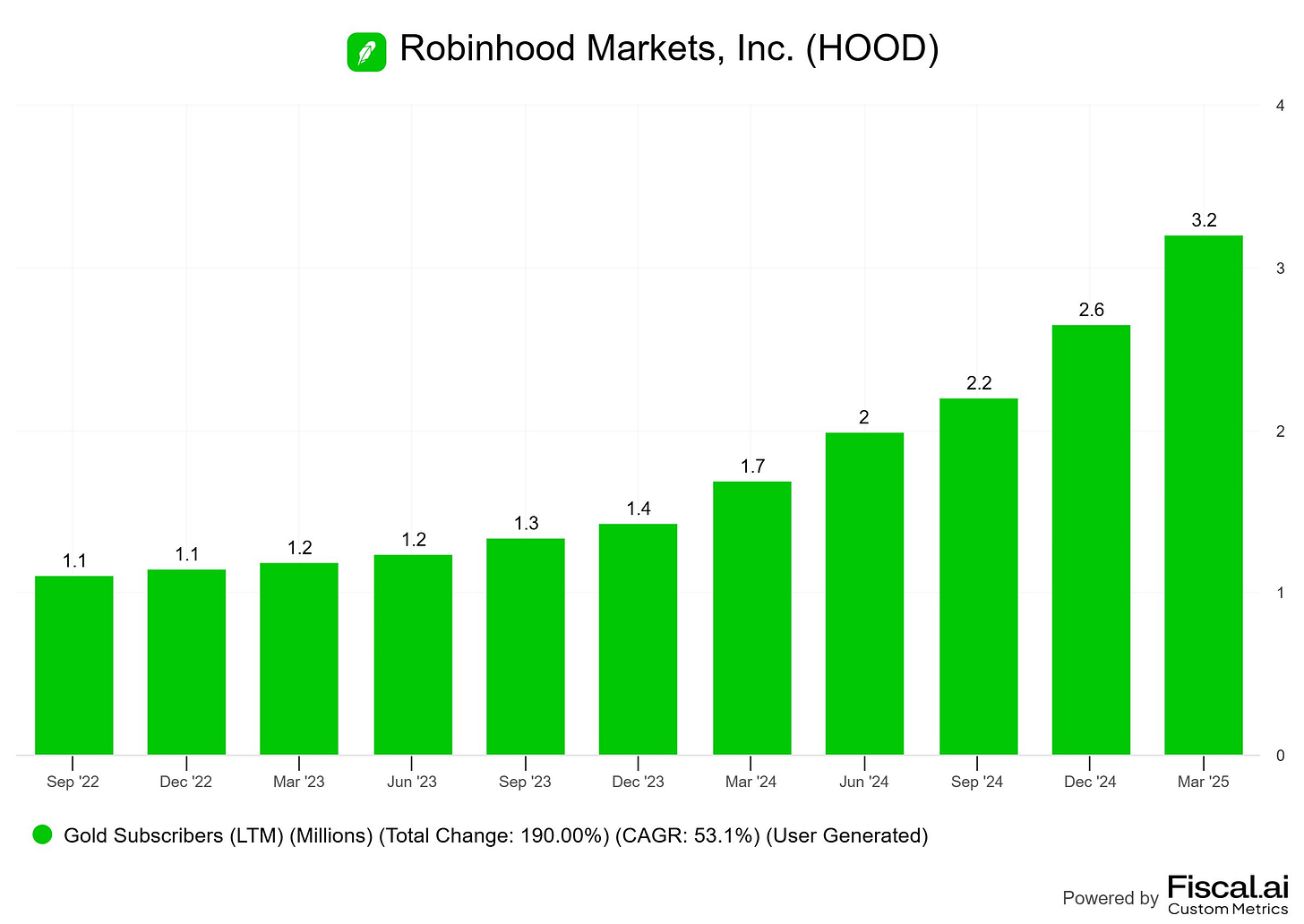

Financially, Robinhood is scaling rapidly, with Q1 revenues up 50% YoY, margins expanding steadily, and a 10x stock price surge over the past two years — evidence of strong execution and market confidence. Specifically, their Robinhood Gold membership is becoming a ‘killer’, a company stalwart.

As of Q12025, Robinhood Gold had 3.2 million subscribers, each paying $5 per month. This translates to an annualised recurring revenue of ≈ $192 million.

Significantly, this 3.2 million figure was an increase by 1.5 million, or 90% YoY.

Overview

Robinhood pioneered commission-free trading and disrupted legacy brokers by making investing accessible to everyone. Over time, it has expanded beyond stocks and options to include crypto, retirement accounts, and cash management.

Revenue is increasingly diversified across nine business lines, each generating over $100 million in annualised revenue, with new products like Robinhood Strategies, Futures, and Banking rapidly scaling.

The best news - It’s only just beginning. The company has over 25 million funded accounts, and this will only accelerate at compounding rates.

The Core Features

Robinhood Gold

Gold is Robinhood’s strongest monetisation engine, transforming casual users into loyal subscribers. The key drivers are;

4% APY on cash (FDIC insured up to $2.5M)

Up to $50K instant deposits

First $1K of margin interest-free, plus discounted rates thereafter

Level II Nasdaq data and Morningstar research.

The key? This is all for just $5 a month! It’s a revenue machine and a no brainer for users. There’s a reason companies like Netflix and Spotify who receive recurring revenues do so well, and Robinhood is capitalising on the same leverage.

Robinhood Legend

Legend serves advanced traders;

Pro-level charts and technical indicators

Sophisticated options analytics and spreads

Customisable dashboards allowing for ease of access

Legend is essentially an easy to use interface, allowing Robinhood to attract seasoned investors. In the company’s Q1 report, they noted that ‘Legend’ “now features increased speed, support for index options and crypto, and new indicators and charts.”

Robinhood Strategies

Whilst not a core pillar, ‘strategies’ offers AI-driven, personalised investment plans designed to help individuals automate their portfolios.

This allows the company to expand reach to passive investors and support long-term AUM growth.

Robinhood Banking

Robinhood is building a neobank:

Checking and savings accounts.

Gold credit card.

Family accounts and advanced cash movement tools.

They are transforming from a pure-play broker into a fully integrated financial ecosystem.

Recent Innovation

Tokenisation and European Expansion

Just this week, Robinhood launched it’s own personal US stock and ETF tokens in the EU, giving eligible customers exposure to US equities with Robinhood Stock Tokens—featuring zero commissions or added spreads from Robinhood. As the company put it in an announcment, “our European app transitions from being a crypto-only app to an all-in-one investment app powered by crypto.” As a result, European customers have access to 200+ US stock and ETF tokens.

Interestingly, the company have also announced equity tokens in private companies such as OpenAI and SpaceX. With the increasing number of firms staying private as their valuation rises, this could provide investors an incredible opportunity; These private company tokens represent indirect economic exposure via special purpose vehicles (SPVs), which hold shares of the private firms — allowing retail investors to participate in their price movements without owning shares directly.

One risk however, is the possible legality of it. Following the launch, OpenAI publicly condemned the tokens, explicitly stating: 'These “OpenAI tokens” are not OpenAI equity. We did not partner with Robinhood, were not involved in this, and do not endorse it. Any transfer of OpenAI equity requires our approval—we did not approve any transfer. Please be careful.'

Prediction Markets

What don’t they have? Robinhood have a dedicated prediction markets hub, allowing customers to trade on outcomes of major global events — from elections to economic data.

In their Q1 report, the company revealed that “over the past six months alone, more than 1 billion event contracts have been traded, proving strong demand for these innovative markets.

Why it matters:

Expands total addressable market beyond traditional assets.

Adds new non-market-dependent revenue streams.

By leveraging prediction markets — an area pioneered by Kalshi and Polymarket — Robinhood positions itself at the intersection of finance, culture, and real-time information, further cementing its super app status.

Invest America

Along with the OBBBA act, the ‘Invest America Act’ has been passed through Congress.

The proposed Invest America initiative envisions giving every newborn American a $1,000 investment account. Moreover, parents are allowed to contribute up to $5,000 into the child’s account.

Whilst the implementation has not yet been discussed, Robinhood has already built a working demo platform for this program.

If the Act was directly linked to the Brokerage, this would further act as a substantial new revenue stream for the company, solidifying Robinhood as the default entry point for future U.S. investors.

24-5 Trading

Robinhood was one of the first major brokerages to introduce 24/5 trading, allowing customers to trade U.S. stocks and ETFs nearly around the clock — from 8:00 p.m. ET Sunday to 8:00 p.m. ET Friday.

We all know 24-7 trading will happen at some stage - IG Markets already allow weekend trading, and when it eventualises, Robinhood will be positioned incredibly to see increased volume and users on its platform.

Valuation and a Potential Catalyst

S&P 500 Inclusion

Despite a ~$83B market cap and consistent profitability, Robinhood is not yet in the S&P 500. Inclusion is likely inevitable and would drive large passive inflows and strengthen institutional support — a major future catalyst. There was speculation on Robinhood being included at the end of Q1 along with the likes of COIN 0.00%↑ and Applovin. It’s only a matter of time. The stock sold off around 10% when it was previously not included at the start of June, although now looking at the chart, you can barely notice it.

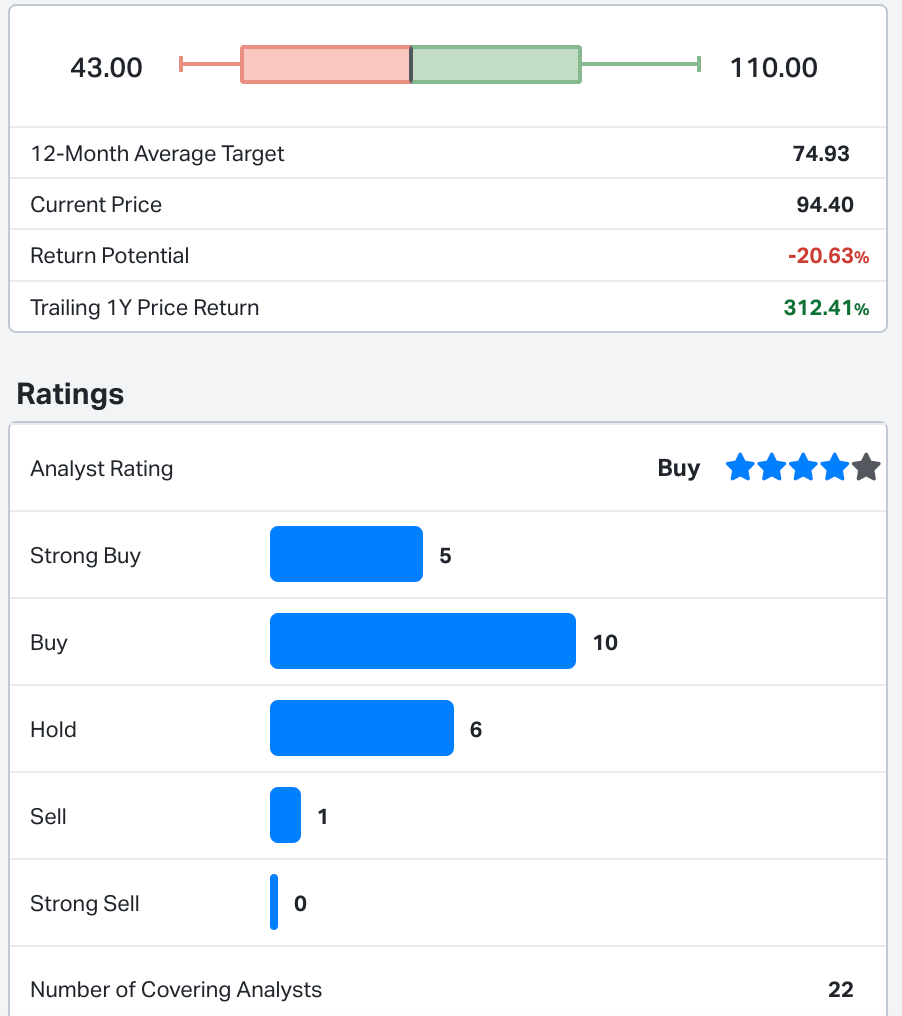

Looking at the stock itself, obviously there’s been a massive run up in 2025 - if you bought at $33 like myself and held through, you would have almost 3x’d your money.

I’ll admit, I did not expect this growth this soon - and neither did the analysts, if you look at the average price targets. $65 was a key level following April’s sell-off that I targeted - the prior high (excluding IPO) in February following 2024 Q4 earnings. I thought any growth above $65 could allow the stock to run up to $80-85, which it had settled at before last weeks token announcement.

For me obviously the stock's risk/reward profile has become less favourable as opposed to when I bought in. However, based on future potential, I am in no hurry to sell shares.

With a beta of around 2.2, of course the stock is volatile. A pullback and consolidation around $80-$85 would not surprise me given the run up, and at the same time, I’d add to my position having taken some profits at $98.

In conclusion, although valuations are high and volatility inevitable, Robinhood’s brand power, design moat, bold innovation, and future catalysts (S&P 500 inclusion, Asia-Pacific expansion, prediction markets) make it a category-defining compounder for the next decade.

For some interesting thoughts on Robinhood, I’d suggest checking out these podcasts:

Great analysis and awesome trade. Vlad and team are killing it!