Portfolio Update - 2025 YTD

The recipe for my market outperformance -> +18.79% YTD, exceeding the S&P500 by 11.45%

Excited to show my first portfolio performance update. This goes over the first two quarters of 2025 - in the future, I will do weekly/fortnightly updates, along with larger quarterly updates.

Overview

Coming into 2025, whilst I’d built up strong fundamental knowledge of the macro picture, my only true investments had come in the hands of a few ASX companies, and Crypto, mainly BTC ETH & SOL, which I rode through much of 2024.

I knew I needed to shift away from both crypto and the ASX - Crypto has great potential, but currently I’m only invested in IBIT (Bitcoin ETF) as I don’t see the relative value compared to investing in a company with tangible values. For the ASX, it’s a personal preference, whilst I live in Australia, I simply don’t see tangible growth in the country excluding our natural resources, and would rather look at investments abroad.

I started this shift around the Yen carry trade drama in August of last year - as Bitcoin sold off greatly, I knew I had to understand more about companies and sectors. So, I started listening to podcasts. That was easy, I’ve always been a podcast person since I was 12-13, listening to a range of Sport and Wellness Podcasts (on 2-2.5x speed).

Starting off with the CNBC daily shows (which I’d recommend to new investors) before expanding my listening — the list of market podcasts and YouTube personalities I follow now is too many to include here — I’d say it took me until around mid-December before I felt like I had a solid enough base of knowledge to back my thesis.

Performance

2025 has been a solid investing year so far for myself, with my current benchmark simply being outperforming the S&P500;

As this is my first true year on record of tracking my investments/having much of my income invested, I’m content but not yet satisfied with the data so far.

Solid outperformance has been driven through adding and trimming to positions and staying diversified, as opposed to focusing on ETF’s (just a personal preference). Obviously, I capitalised on April’s tariff drama, but, prior to, and post liberation day, I’ve maintained and expanded my relative outperformance vs the index.

Current Holdings

The portfolio is by no means perfect. To be honest, I’d rather trim the number of holdings down to around 10-20, although at the same time, there are still so many names I’m interested in.

Looking at overall performance as seen in the first image, I’ve been fortunate enough to have much of my biggest gainers in % terms be my largest positions - HOOD 0.00%↑ , NVDA 0.00%↑ , NFLX 0.00%↑ , and UBER 0.00%↑. Having approximately half of my holdings yielding unrealised gains of >20% is great, although with many of these companies, I wish I had more invested, something I’ll speak about shortly.

Whilst not investing Hedge fund level funds, I have principles with which I am to stick with - for example, with Alibaba, whilst my unrealised loss stands at 23.51%, I have realised gains of 22% - I initially bought in January at $86(approximately)/share, sold 25% at $130 and more at $115, before buying some more sadly at $142(as I thought the company would break out).

It’s no secret that Robinhood has been my most favourable position - having initially invested in the company at $32.98 on April 8, I’ve both added and taken profits in my position, leaving a realised gain of 18% and unrealised gain of 84%. I talk about my HOOD 0.00%↑ thesis here!

Looking at the downside, excluding BABA 0.00%↑, my other big loser is LLY 0.00%↑, although thankfully this is a marginal position - in reality, this is due to personal laziness - something I’m about to discuss.

Mindset/Thesis

For myself personally, there’s a few things holding me back, that have capped my gains in dollar terms (and technically percentage terms).

Firstly, the principle side. One thing I’m attempting to overcome is overall laziness/negligence when it comes to positions/potential investments. In general, I don’t like to add or alter positions in two scenarios.

When a stock has already had a sizeable run recently

This mainly relates to companies on my watch list - I’ll see a company I like that has run up 10-15% in a few days/weeks, and instead of buying, prefer to wait for a pullback. This has worked with positions like Novo Nordisk, Hims, and Uber. Yet, often, more-so with speculative names, I wait for a pullback, and miss the move entirely - currently this relates to companies like SEZL 0.00%↑ (at around $120 mark), DASH 0.00%↑ at $165, ASTS 0.00%↑ at $28 and SOFI 0.00%↑ at $12. Watching these stocks continue to run certainly isn’t fun. Another one is OSCR 0.00%↑, although this week it has had a pullback, I need to do some more analysis though.

When I haven’t done thorough analysis on the company

This is similar to the points above, allocating significant amounts of time to work, listening to podcasts and preparing for newsletters, along with socialising often affords me little time to dive into prospective companies, such as Sezzle and ASTS. With university set to resume soon, my lack of time available will likely accelerate.

Again, this often means I’ll add a stock to my watch list, and wait to look into the company, but by the time I’ve done so, I may have missed the move.

Another principle I’d like to implement which may help reduce my number of positions, is to implement a minimum buying order in dollar terms- around 4x what I initially invested in LLY. Due to overall market uncertainty, my previously discussed laziness when it comes to creating positions and income from work, when I look at it, I’m only around 55% invested right now. I’d like to be around 80% (in fairness, I may increase allocations in the next couple weeks marginally).

Strategy for Q3

If we get through next week’s possible tariff drama, then the way I see it, technicals point to continued upward momentum for the next couple weeks/months as we go into earnings season - I’ll discuss this next week, but expected growth rates are around 3% for Q2, and I think this can easily surprise to the upside! I would take any correction in markets to add to positions/finally create new positions (I currently have in excess of 200 tickers in my watch list).

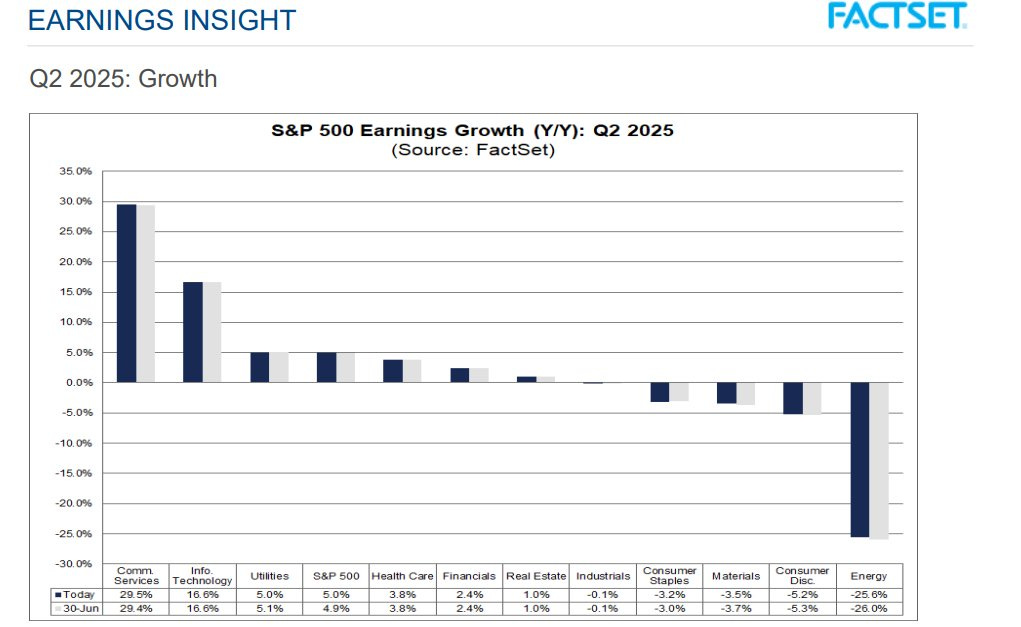

Sector wise, much of my performance has been from tech-heavy momentum growth stocks. Given the earnings projections below, I think these names will continue to lead the charge.

I’d also like to continue to diversify ex U.S. Sure, I have some German and Asian diversification, but, this should be more. I like some Europe defence names, along with the EWY 0.00%↑

Sector wise, I’m looking into Robotics, look pretty good right now, adding to Financials and Cybersecurity exposure, Aerospace/Drones/Defence, and possibly Biotech - the technicals on the XBI 0.00%↑

I’m under no illusion that most people fail to outperform the market, at the moment, I’m happy with my strategy, and will keep improving

Thanks for reading.

Toby

Very informative!